There have been lively discussions recently in various corners about the need for finance to do more in the realm of business analytics. The general sentiment seems to be that finance, where natural analytical talent resides, has a great deal to offer to operating managers who are trying to discern the most favorable options for growth.

Which customer segment deserves more hand-holding? Will more hand-holding pay off with better retention rates and more consistent levels of profitability? Which new market opportunity to jump on? Which option would incur an unbearable level of

Without a doubt, financial planning and analysis (

FP&A: Top Improvement Target

In December 2014, APQC fielded a survey to learn what financial process improvement projects are top priorities for 2015. The survey was sent to APQC’s audience segment that is called “Business Excellence.” These are people with titles such as enterprise process architect. They are credentialed in process management, change, and quality. They parachute in from a central group to manage large transformation projects within administrative functions such as finance,

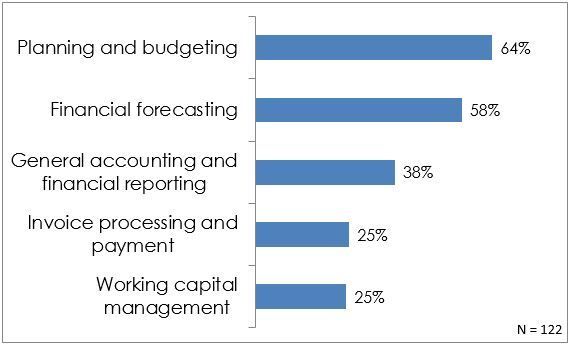

Planning and forecasting are the most prevalent activities that the change agents are working on in 2015 (Figure 1). The implication is that finance must do a better job of helping operating managers allocate resources wisely as they pursue promising opportunities.

Top Five Financial Management Process Improvement Priorities*

Figure 1

David Axson, a Managing Director in Accenture’s Finance and Enterprise Performance practice, says the majority of CFOs now have to grapple with business conditions characterized by persistent volatility. Axson also directs thought

*Survey participants were told to “check all that apply” from a long list of items.